|

|

#1 |

|

Участник

|

Leon's CRM Musings: Dynamics CRM vs Salesforce: User Adoption July 2011

Источник: http://leontribe.blogspot.com/2011/0...orce-user.html

============== Last year I reviewed the subscription numbers of Dynamics CRM and salesforce. At that time I came to a few conclusions:

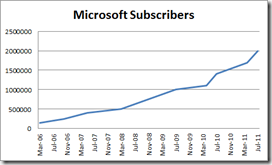

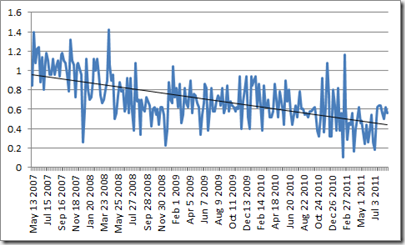

Customer Size Here are the numbers for salesforce taken from the salesforce detailed financials: Year Month Subscribers Customers Average Company Size 2003 Q4 Dec-02 76,000 5,700 13 2004 Q1 Mar-03 85,000 6,300 13 2004 Q2 Jun-03 96,000 7,000 14 2004 Q3 Sep-03 107,000 7,700 14 2004 Q4 Dec-03 127,000 8,700 15 2005 Q1 Mar-04 147,000 9,800 15 2005 Q2 Jun-04 168,000 11,100 15 2005 Q3 Sep-04 195,000 12,500 16 2005 Q4 Dec-04 227,000 13,900 16 2006 Q1 Mar-05 267,000 15,500 17 2006 Q2 Jun-05 307,000 16,900 18 2006 Q3 Sep-05 347,000 18,700 19 2006 Q4 Dec-05 393,000 20,500 19 2007 Q1 Mar-06 438,000 22,700 19 2007 Q2 Jun-06 495,000 24,800 20 2007 Q3 Sep-06 556,000 27,100 21 2007 Q4 Dec-06 646,000 29,800 22 2008 Q1 Mar-07 742,900 32,300 23 2008 Q2 Jun-07 800,000 35,300 23 2008 Q3 Sep-07 952,500 38,100 25 2008 Q4 Dec-07 1,100,000 41,000 27 2009 Q1 Mar-08 1,177,200 43,600 27 2009 Q2 Jun-08 1,287,900 47,700 27 2009 Q3 Sep-08 1,398,600 51,800 27 2009 Q4 Dec-08 1,500,000 55,400 27 2010 Q1 Mar-09 1,660,400 59,300 28 2010 Q2 Jun-09 1,769,600 63,200 28 2010 Q3 Sep-09 2,000,000 67,900 29 2010 Q4 Dec-09 2,102,500 72,500 29 2011 Q1 Mar-10 2,319,000 77,300 30 2011 Q2 Jun-10 2,554,400 82,400 31 2011 Q3 Sep-10 2,790,400 87,200 32 2011 Q4 Dec-10 3,000,000 92,300 33 2012 Q1 Mar-11 3,321,800 97,700 34 2012 Q2 Jun-11 3,640,000 104,000 35 Here are the Dynamics CRM numbers: Month Subscribers Customers Average Company Size Mar-06 150000 6000 25 Jul-06 200000 7000 29 Oct-06 250000 8000 31 May-07 400000 10000 40 Mar-08 500000 11000 45 Jul-09 1000000 20833 48 Apr-10 1100000 22000 50 Jul-10 1400000 23000 61 Apr-11 1700000 27000 63 Jul-11 2000000 30000 67 Numbers in red are my best guess, based on the known numbers. Essentially I have estimated the customer size and then used this to generate the subscriber size. I thought it was important to include my large tables of numbers, rather than just show the pretty graphs so others can see how I generated them and also slice and dice them as they see fit. As can be seen, Dynamics CRM’s average customer is now almost double the size of the salesforce average customer. Graphing the company sizes, we see my previous thoughts that the sizes were tapering was unfounded, both are increasing and it appears Microsoft’s are growing a little faster as the ratio has now gone from 1.5 to 2.0.   Market Maturity Here is the apples to apples combined data. Month SFDC Subscribers SFDC Customers MSFT Subscribers MSFT Customers Subscriber Ratio Customer Ratio Difference in Subscribers Total Subscribers Customer Size Ratio Mar-06 267,000 15,500 150000 6000 1.78 2.58 117,000 417,000 1.5 Jul-06 315000 17500 200000 7000 1.58 2.50 115,000 515,000 1.6 Oct-06 366700 19300 250000 8000 1.47 2.41 116,700 616,700 1.6 May-07 482000 24100 400000 10000 1.21 2.41 82,000 882,000 2.0 Mar-08 742,900 32,300 500000 11000 1.49 2.94 242,900 1,242,900 2.0 Jul-09 1324809 49067 1000000 20833 1.32 2.36 324,809 2,324,809 1.8 Apr-10 1696800 60600 1100000 22000 1.54 2.75 596,800 2,796,800 1.8 Jul-10 1878243 64767 1400000 23000 1.34 2.82 478,243 3,278,243 2.1 Apr-11 2449000 79000 1700000 27000 1.44 2.93 749,000 4,149,000 2.0 Jul-11 3819600 106100 2000000 30000 1.91 3.54 1,819,600 5,819,600 1.9 In this case I have extrapolated the salesforce data to match the month the Dynamics CRM numbers were announced. So if the Dynamics CRM number was announced one month after a salesforce quarter announcement, I guess the SFDC customer number and then use the guessed average customer size to generate a subscriber number. Total subscribers across both products know no bounds and both products continue to bring on subscribers.    It is fair to say this market is still far from maturing with no signs of populations tapering. In terms of my previous predictions, the trending of Excel came through with the goods. Salesforce made three million subscribers somewhere between September 2010 and December 2010 (I predicted October 2010). Dynamics CRM made 1.5 million subscribers somewhere between July 2010 and April 2011 ). I predicted December 2010. For my next set of predictions, I believe salesforce will make four million subscribers before the end of the year but after the Q3 results. Dynamics CRM will make 2.5 million subscribers before the end of the year and probably before November. Is Dynamics CRM Catching Up? So the big question is if Dynamics CRM is catching up on salesforce. The answer, unfortunately for those of us on the Microsoft side of the fence, is no. The boost in numbers from the international rollout has either not happened or has been insufficient. Here is the evidence.   The subscriber ratio (SFDC subscribers/MSFT subscribers) was dropping or, at least, was stable at just under 1.5 until the last quarter where salesforce has jumped away. The subscriber difference tells the same story. While there was a possible turning point in mid-2010, this appears to be an aberration with salesforce running away. So what has happened? Has salesforce become really good and left Dynamics CRM in the dust? Is something else at play? It is true that salesforce has been making a lot of acquisitions but, functionally, the differences in the Sales Cloud and Service Cloud products are more on the edges than at the core and equal on both sides. Salesforce has Chatter, Dynamics CRM is soon to have a Chatter equivalent but has SharePoint and Lync instead. Dynamics CRM has better Outlook integration but its browser client is limited to Internet Explorer (until early next year) and so on. This idea of equivalency is also confirmed by the Gartner and Forrester reports which rate both products very highly. My speculation is the reason the salesforce numbers have leaped is because of the mix of products that make up the totals. The salesforce numbers cover all their products, not just the Sales Cloud and Service Cloud products. They include Chatter, Jigsaw, Heroku, Radian6 and so on. I imagine it only includes paying Chatter clients but it is not clear. Unfortunately, with salesforce announcing they will not be regularly releasing customer figures any more, it is difficult to know. As for popularity, Google Trends suggest Dynamics CRM is still catching up with salesforce in terms of search results.  This is a graph of the search popularity of “dynamics crm” and “salesforce.com”. As can be seen, the gap is narrowing. Any Financial Insights? I talked last week about my concerns for any company selling ten dollar bills for nine dollars. Combining the finances with the subscription numbers we see something else of interest. Back in May I noticed that subscribers are becoming increasingly less profitable for salesforce. Here is the graph.  Here I have taken the salesforce subscription numbers above and the financial numbers from the detailed summary I used in last week’s blog. ‘PUPM’ stands for ‘per user per month’. So, in the case of ‘Revenue PUPM’, this is the revenue received by the average subscriber each month. In this case the number has tapered to around $50 and has been stable for the last 12 months. Revenue Cost is a figure salesforce use claiming it is the expenses directly related to the revenue, ignoring those inconvenient operating costs of sales and marketing and research and development. The revenue cost per subscriber per month is at around $10 and has been there for almost three years. Those pesky, expensive operating costs (sales and marketing, research and development and general and administrative costs) have hovered at around $40 per subscriber per month for about two years. Doing the maths, the profit of a subscriber is $50 (revenue) – $10 (revenue cost) – $40 (operating cost) = $0 (profit). The variable for profitability appears to be the operating costs per subscriber. While it is hovering around $40 per subscriber per month, if this could be reduced, this would bring salesforce into profitability. Conclusions Both products are growing without obvious bounds and the market still appears to be growing for the two products. In terms of customer size, Microsoft CRM is penetrating the enterprise more effectively than salesforce products with the average Dynamics CRM customer size now being double the size of a salesforce customer. In terms of catching up, it seems as if the range of salesforce products is getting away from Dynamics CRM, but that is ok. Without a clearer understanding of how the salesforce customer and subscription numbers are broken down, the comparison has only limited value. As for ‘front of mind’, Google Trends suggests Dynamics CRM is catching up on salesforce. Finally, the financials for salesforce mean that they are not making money from their subscribers and the financials seem to be settling at around breakeven. Without reducing their operating costs, it is not clear how this situation will change. Источник: http://leontribe.blogspot.com/2011/0...orce-user.html

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

| Опции темы | Поиск в этой теме |

| Опции просмотра | |

|