|

|

#1 |

|

Участник

|

dynamicsaxtraining: Basic concepts

Источник: http://www.dynamicsaxtraining.com/fi...basic-concepts

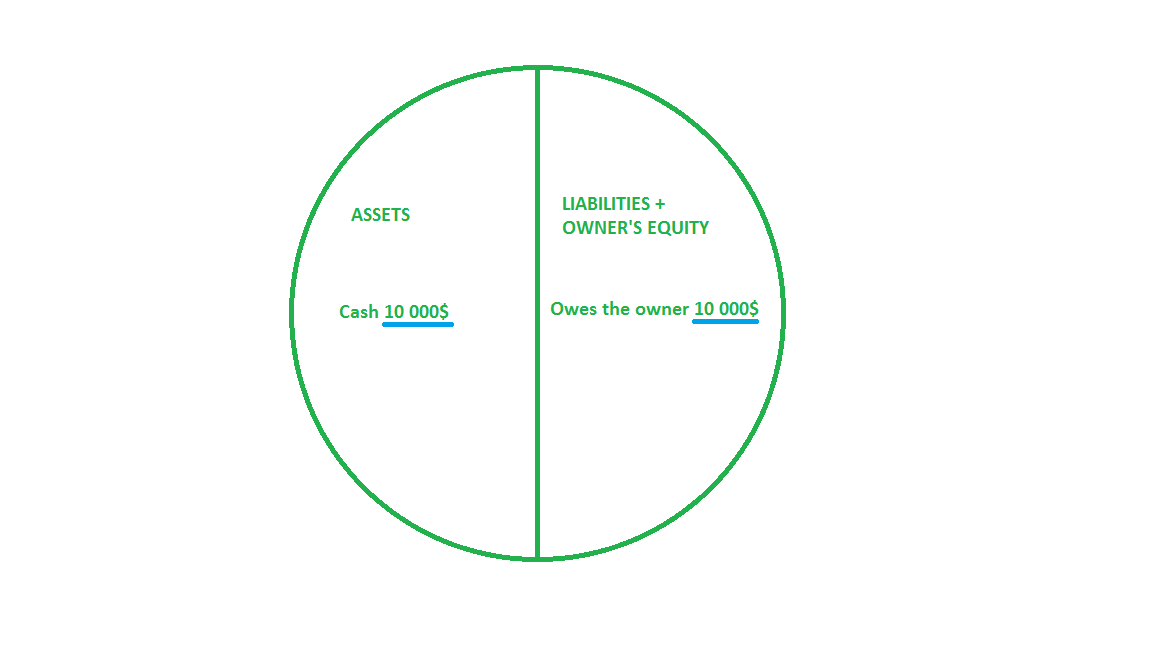

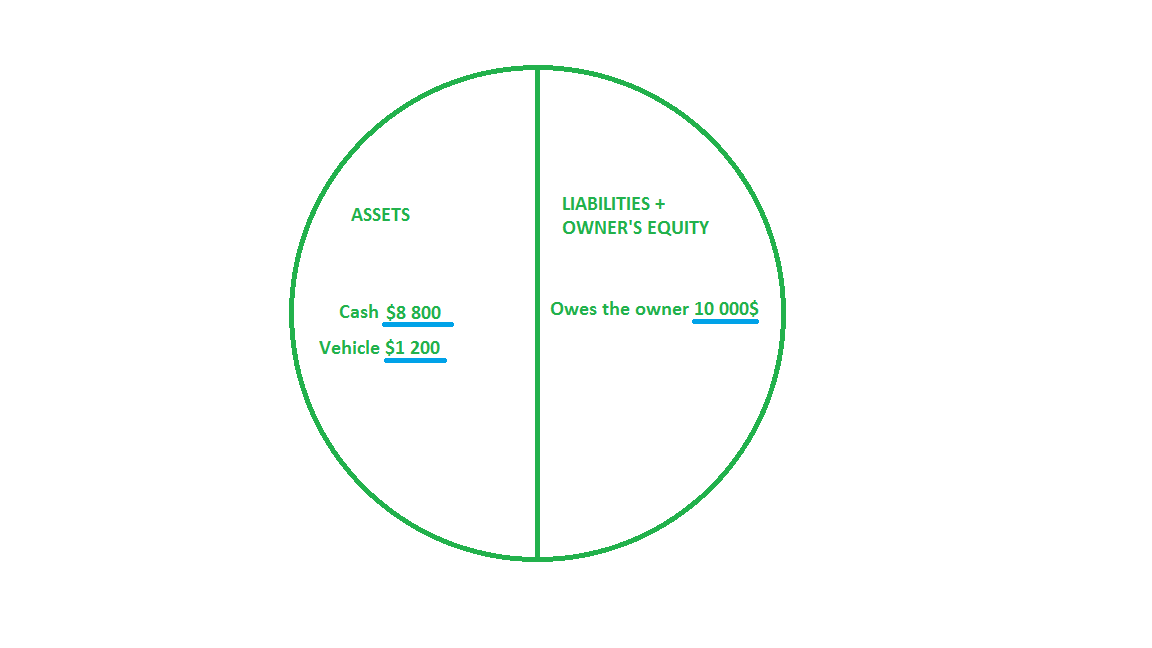

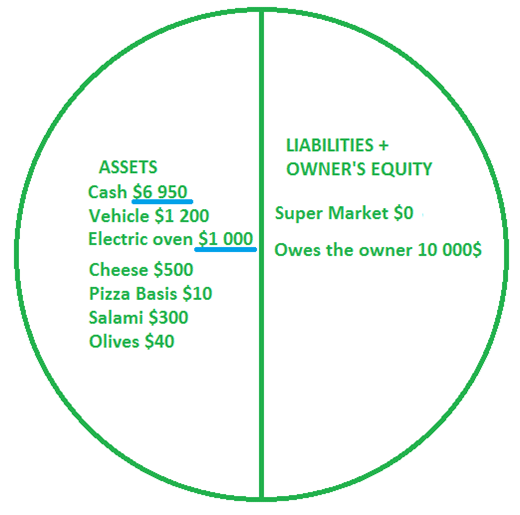

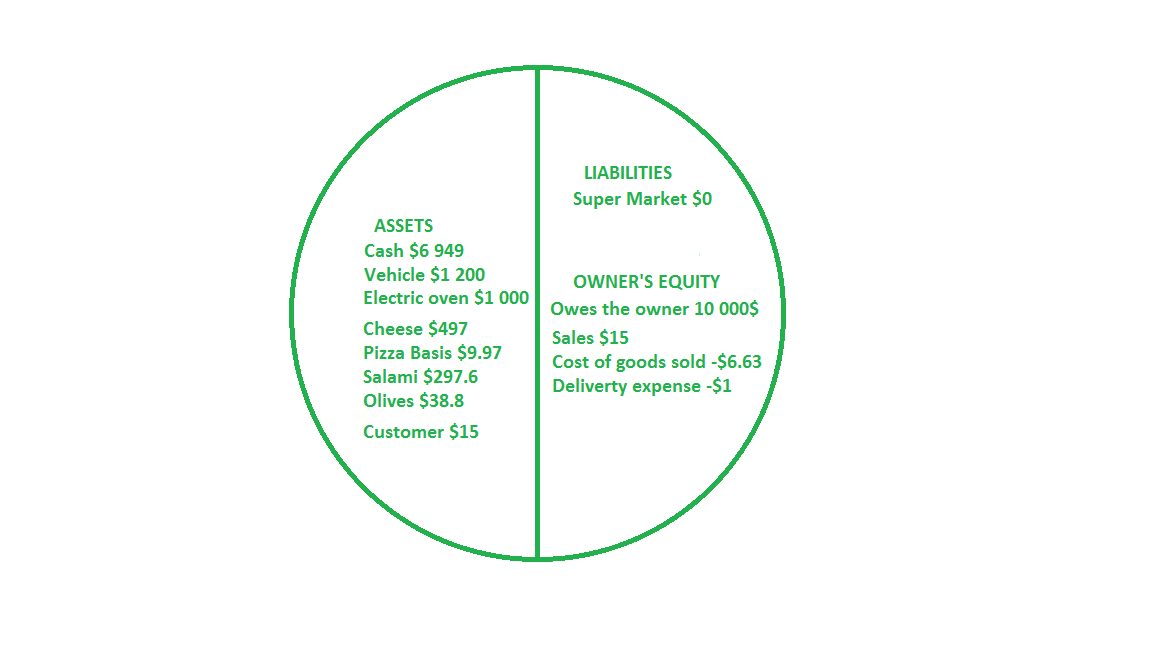

============== In this training lesson, we will study what accounting is, what its main principles are, its terminology, and how accounting is used in a company. The accountingcoach.com is a very good site with clear and concise explanation of Accounting. Let’s assume that Taras goes into the pizza business – namely, cooking and selling pizza. The name of the new company is The Tastiest. Taras will start his business by putting some of his personal savings into it. In effect, he is buying shares of The Tastiest’s common stock. This is the first initial transaction – the company receives cash but at the same time the company has a debt. Try to illustrate this transaction. First Transaction Imagine a circle which represents the whole company, its left side is the Assets and its right side is the Liabilities. Assets are the things that the company owns and are sometimes referred to as the resources of the company. Liabilities are obligations of the company; they are amounts owed to others. What the company owes the outsiders call Liabilities and what it owes the owner calls Owner’s Equity. So, the right side is Liabilities and Owner’s Equity (the type of Liabilities). At the beginning the circle looks like a dot, because the company doesn’t have any Assets and Liabilities. When Taras invests some of his personal money, the following occurs: the company gets cash (which is the Assets), but the company owes the money to Taras. Let’s assume that Taras invests 10 000$ into his business. The circle will look as follows:  Company balances after investment Company balances after investmentThe circle demonstrates the basic accounting equation: Assets = Liabilities + Owner’s Equity. The accounting equation should always be in balance. It guarantees that the money cannot appear from anywhere. In our case the company cash (Assets) was given by the owner (Liabilities). The field of accounting—both the older manual systems and the today’s basic accounting software—is based on the 500-year-old accounting procedure known as double entry. Double entry is a simple yet powerful concept: each and every one of a company’s transactions will result in an amount recorded into at least two of the accounts in the accounting system. In our case, the first transaction records the amount to the “Cash” and “Owes the owner” accounts. Owe the owner => $10 000 => Cash The transaction could be recorded in the following manner: Cash Owe the owner 10 000 $ 10 000 $ The dual form of transaction is caused by natural law. Nothing is lost in the universe, it is only changed. You can transfer an apple from one hand to another and you can also observe it separately: for the 1st hand –minus one apple, for the 2nd hand – plus one apple. The accounting equation is in balance: $10 000 (Cash) = $0 (Liabilities) + $10 000(Owner’s Equity). Purchase Vehicle for Cash The Company decides to purchase a used delivery car which costs 1200 $ by writing a check for $ 1 200. In this case, the new account which is called Vehicles (or Delivery equipment) is required. Vehicles is an Asset account. The list of all company accounts is named the Chart of Accounts. The chart of accounts is a listing of the account names that a company has identified and made available for recording financial transactions. A company has the flexibility to tailor its chart of accounts to best suit its needs, including adding accounts as needed. This transaction records the amount to the Cash and Vehicles accounts. Cash => $ 1 200 => Vehicles The transaction could be recorded in the following manner: Cash Vehicles $1 200 $1 200 According to the Double entry procedure, one amount is used for the two accounts. Because the amount cannot be taken from anywhere. In our case it is $1 200. But in this case, the accounting equation is not in balance: $10 000 (Cash) + $1 200 (Cash) + $1 200 (Vehicles) ≠ $0 (Liabilities) + $ 10 000 (Owner’s Equity). It is logical that Cash is decreased, but according to the double entry procedure, it is impossible to create the following transactions: Cash Vehicles -$1 200 $1 200 How was this problem solved by the middle ages accountants? They decided to divide all accounts into two parts. In one part, they recorded all amounts that increased the account amount, in the other part, they recorded all amounts that decreased the account amount. They called these parts as Debit and Credit. For example, if the Cash increases, the amount is recorded into the Debit part, if the Cash decreases, the amount is recorded into the Credit part. The total Cash amount is calculated in the following manner Debit – Credit. In our case, the accounts will have the following view after the two transactions: Cash Owe the owner Vehicles Debit Credit Debit Credit Debit Credit $10 000 $10 000 First transaction $1 200 $1 200 Second transaction Note that if the amount is debited in one account, the same amount should be credited in another account, because the money cannot be taken from anywhere. So one account is Debited and the other account is Credited, and vice versa. It is impossible that in one transaction both accounts are Credited (or Debited). When we sum all Debit amounts from all accounts and sum all Credit amount, they will be the same, i.e. Debit = Credit. Let’s check the accounting equation. In the accounting equation, the total account amount is used without debit or credit parts. Total “Cash” amount is $10 000 (Debit) – $1 200 (Credit) = $8 800. Total “Owe the owner” amount is $0 (Debit) – $ 10 000 (Credit) = – $10 000. Total Vehicles amount is $1 200 (Debit) – $0 (Credit) = $1 200 $8 800 (Cash) + $1 200 (Vehicles) ≠ $0 (Liabilities) – $ 10 000 (Owner’s Equity). Something is wrong again, the amount is correct but the sign is different. We have made one mistake, because we assumed that the Debit part contained the amount that increased the total account amount, the following formula was used Debit – Credit. But, for the Liabilities and Owner’s Equity accounts it is not true. Look at the first transaction, both accounts are increased! The “Owe the owner” account was increased by $10 000 with the help of Credit part. So, the total “Owe the owner” amount should be calculated in the following manner: $10 000 (Credit) – $0 (Debit) = $10 000. Remember the total account amount for Liabilities and Owner’s Equity accounts is calculated in the following manner: Credit – Debit. Remember that any Debited account is “good” for a company, and any Credited account is “bad” for a company. For example, when the Cash account is debited it is good because the company’s cash is increased. When the Cash account is credited it is bad because the company’s cash is decreased. When the “Owes the owner” account is credited, it is bad because the company’s debt to the owner is increased. Note that in both cases the amount is entered in the Credit part, the cash is decreased, but the debt is increased and in both cases it is bad for the company. Look at our circle after the second transaction. The circle has almost not changed. The money was moved from one asset account to another. Note that all accounts contain the total amount. For the asset accounts the total amount is Debit – Credit, for the Liabilities and Owner’s Equity accounts, it is Credit – Debit.  Company balances after purchase Company balances after purchasePurchasing Pizza Ingredients To prepare pizzas, the Company decides to purchase, for example, the following ingredients:

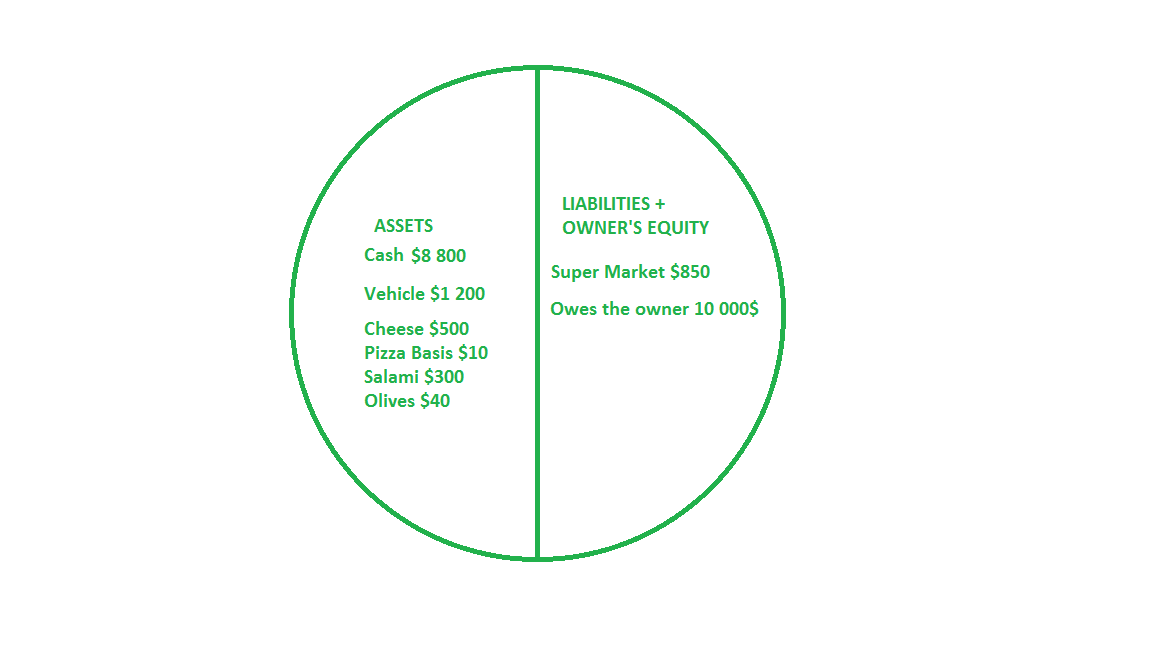

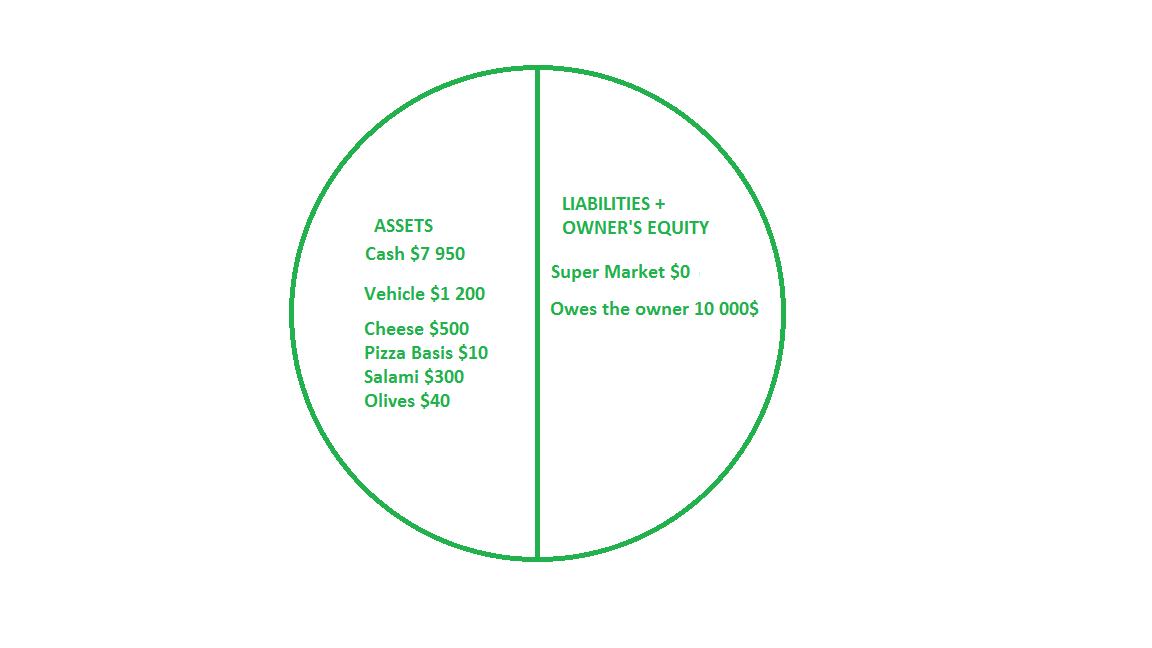

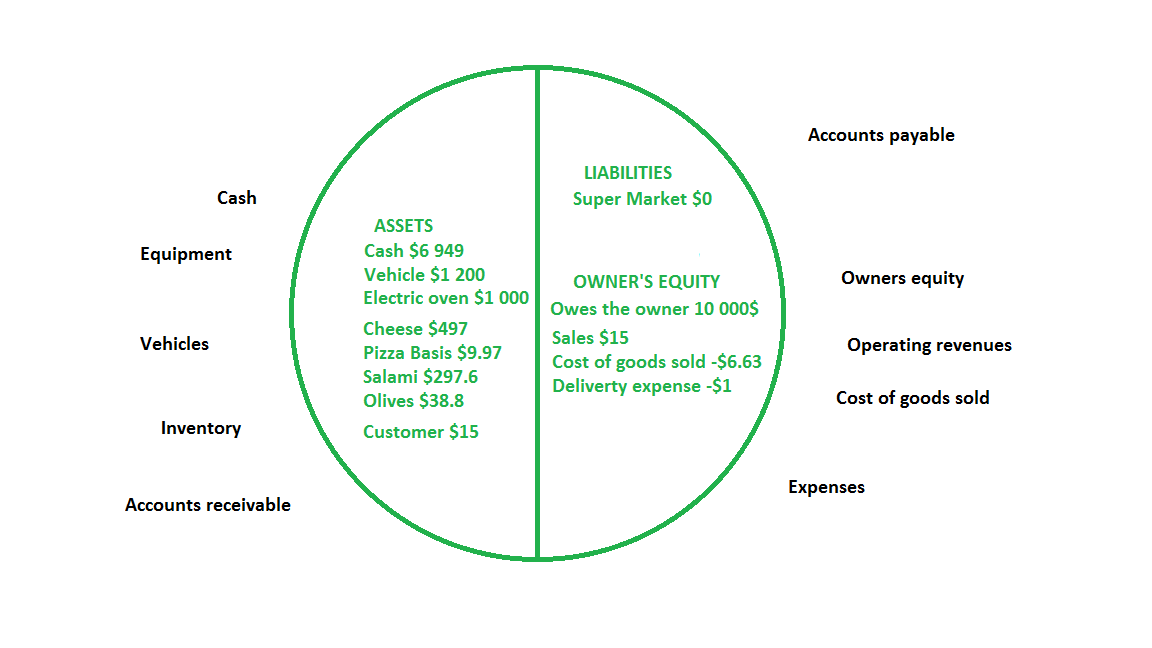

The purchase operation has the following transactions: Super Market Cheese Pizza basis Salami Olives Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit $500+$10+$300+$40=$850 $500 $10 $300 $40 The Super Market total amount is increased. Since Super Market belongs to the Liabilities accounts, the amount is recorded in the Credit part (Account amount = Credit – Debit). The other explanation – since the liabilities are increased, it is bad for the company, so the amount is recorded to the Credit part. The Cheese and other ingredients accounts are also increased. Since they belong to the Assets accounts, the amount is recorded to the Debit part (Account amount = Debit – Credit). The other explanation – since the assets are increased, it is good for the company, so the amount is recorded to the Debit part. The circle is increased and will look as follows:  Company balances after second purchase Company balances after second purchaseNote that all accounts in the circle contain the total amount, for the assets it is Debit – Credit, for the liabilities and owner’s equity, it is Credit – Debit. The circle is increased because someone has lent the money to our company. In this case, it is the Super Market. In the first transaction, the circle is increased, because Taras lends (invests) money to the company. Note that for the company doesn’t care who lends the money the Vendor or the Owner, this money is company liabilities. Let’s check the accounting equation: $8 800 (Cash) + $1 200 (Vehicles) + $500 (Cheese) + $10 (Pizza base) + $300 (Salami) + $40(Olives) = $850 (Liabilities) + $ 10 000 (Owner’s Equity). When Taras pays for the ingredients, the circle will be decreased. The transaction will have the following view: Cash Super Market Debit Credit Debit Credit $850 $850 The company’s Cash is decreased, since the Cash amount is Debit – Credit, the Credit part should be increased. The other explanation – the company’s Cash is decreased, it is bad for the company, so the Credit part is used, the debt to the Super market is decreased, it is good for the company, so the Debit part is used. The circle is decreased and will have the following view:  Company balances after payment Company balances after paymentThe circle shows the current snapshots of the accounts totals. The transaction information must be stored separately for each account, if we look, for example, at the Cash account, we can get the following information: Cash Debit Credit $10 000 $1 200 $850 In this case, we can understand why our company has only $7 950 cash. You can note that it is not clear why the Cash was increased by $10 000 or decreased by $850 and you will be right. To understand what happened, we should look at all accounts that were involved in one transaction. For this purposes, a voucher is used. A voucher is an identification which is assigned to all amounts recorded in scope of one transaction. For example, the last transaction uses the “Voucher_4” identification. The transaction will look as follows: Cash Super Market Debit Credit Debit Credit $850 (Voucher_4) $850 (Voucher_4) When we look at the Cash account, we can get the following information: Cash Debit Credit $10 000 $1 200 $850 (Voucher_4) So now, to answer the question why our cash account was decreased by $850, we should search through all the accounts and find where the Voucher_4 identification is available. In our case, it is the Super Market account. On the basis of the voucher identification, we restore the following transaction: Cash => $850 => Super Market. So, the cash account is decreased because the company paid to the Super Market vendor. Selling Pizza Let’s look how the company sells. Taras receives the first order for 1 pizza which costs $15. Let us assume that Taras has already purchased an electric oven for $1000. The updated circle will look as follows (the transaction is similar to the vehicle purchase):  Company balances after purchase Company balances after purchaseFor one pizza, Taras uses 1 pizza base for $0.03 ($10*1/300), 0.3 kg of cheese for $3 ($500*0.3/50), 0.2 kg of salami for $2.4 ($300*0.2/25), and 0.15 kg of olives for $1.2 ($40*0.15/5). He notes that for making one pizza, the electric oven uses electric energy for $0.2. He has decided not to take into account the electric energy and personal labor. Taras also pays $1 for the express services. Let’s calculate the total cost of goods sold: $0.03 + $3 + $2.4 + $1.2 = $6.63 The sales operation will have the following transactions: Customer Sales Debit Credit Debit Credit $15 $15 Cheese Pizza basis Salami Olives Cost of goods sold Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit $3 $0.03 $2.4 $1.2 6.63 Cash Delivery Expense Debit Credit Debit Credit $1 $1 Let’s analyze the Debit and Credit parts of accounts. Note that the new accounts were used. They are Customer, Sales, Cost of goods sold, and Delivery Expense. In the first transaction, we use the Customer and Sales accounts. The Customer account is the company’s Asset, because this account contains the amount that the Customer must pay to the Company. Since this Asset is increased by $15 the Debit part is used. We already know that in one transaction, the Debit part should be equal to the Credit part. So, for the Sales account, the Credit part is used. At first sight, the Sales is the Asset account, because it contains the amount of money that the company earns. But, it is not the Asset. Because the company should give all profit to the owners. The Sales account contains the amount that must be returned to the company owners, in other words, Sales is similar to Liabilities. In the second transaction, we use the Cost of goods sold account. The Cheese, Pizza basis, Salami, and Olives account are the Assets accounts. For the Assets account, the account amount is Debit – Credit. Since the account amount is decreased, the Credit part is used. In other words, the quantity of ingredients decreased in the stock – it is bad for the company, the Credit part is used. Since in one transaction, Debit = Credit, the Debit part is used for the Cost of goods sold account. Cost of goods sold is similar to the company Assets account. The Sales and Cost of goods sold accounts answer the question whether the Company makes profit. If Sales plus Cost of goods sold are more than zero, the company is profitable. These accounts are named the Profit & Loss accounts. All Profit & Loss accounts are located on the right side of the circle. Because the Company makes profit, then this profit should be returned to the owner. In other words, the company’s profit is the liabilities. Since the Profit&Loss accounts belong to the Liabilities, the total Profit & Loss amount is Credit – Debit (of all Profit&Loss accounts). Note that the Sales total amount is positive and the Cost of goods sold total amount is negative. The circle will look as follows:  Company balances after sales Company balances after salesNote that the circle contains the total account amount, for the Assets, it is Debit – Credit, for the Liabilities and Owner’s Equity, it is Credit – Debit. For example, for the Sales account, it is $15(Credit) – $0 (Debit) = $15, for the Cost of goods sold account, it is $0 (Credit) – $6.63 (Debit) = -$6.63. You may note that Delivery Expense is also the Profit&Loss account. Let’s check the accounting equation: $6 949 (Cash) + $1 200 (Vehicle) + $1 000 (Electric oven) + $497 (Cheese) + $9.97 (Pizza Basis) + $297.6 (Salami) + $38.8 (Olives) + $15 (Customer) = $0 (Liabilities) + $10 000 (Owes the owner) + $15 (Sales) – $6.63 (Cost of goods sold) – $1 (Delivery expense). 10 007.37 = 10 007.37 The company’s profit equals the total Profit&Loss amount. Taras’s Company earns $7.37. Note that the company’s circle increased by $7.37. The total Assets amount is 10 007.37, the total Liabilities amount is 10 007.37. If the circle increased, then the company’s Assets and the company’s Liabilities are increased. In other words, the company’s cost or value increases. But, remember that the Liabilities divided to Owner’s Equity and other Liabilities. It is very good if the Owner’s Equity increases and it is not very good if other Liabilities increase. In the first case, the company owes the money to the owner, in the second case, the company owes the money to other(s). In this example, the Customer hasn’t paid for the pizza yet. When the Customer pays for the pizza, the following transaction should be recorded: Cash Customer Debit Credit Debit Credit $15 $15 The debit part for the Cash account is used, because the company’s cash is increased (it is “good” for the company). The credit part for the Customer account is used, because the Customer has decreased his debt to the company (it is “bad” for the company, because the Customer’s debt is decreased). If we look at the Customer account, we can see the following: Customer Debit Credit $15 $15 We can see that the Customer amount is zero ($15 (Debit) – $15 (Credit)). In other words, the Customer pays for the items, and has no debt to our company. In real life, we receive the money for the pizza the same time when we deliver it. In this case, the payment transaction is included in the sales operation. But, when the company sells items to other companies, the payment occurs during the payment period. It can be 2 weeks, 1 month, or even 3 months after the items are delivered, in other words, during any time period. Remember that the revenues are recognized as soon as a product has been sold, regardless of when the money is actually received. It is the accrual basis of accounting the type of revenue recognition principle. Note that in our example, we calculate the revenue before the payment operation. It doesn’t matter when the payment occurs, because we assume that the money already belongs to us. Chart of Accounts You can ask how many accounts there can exist. Each company has its own set of accounts. An account contains information about the amount of money that is used. One company sells books and has the Books account, another company sells cars and has individual accounts for each car brand (Fiat, ZAZ, Daewoo, Mercedes, etc). For convenience, the smart accountants who lived several centuries ago classified all accounts by groups. The main groups of accounts are:

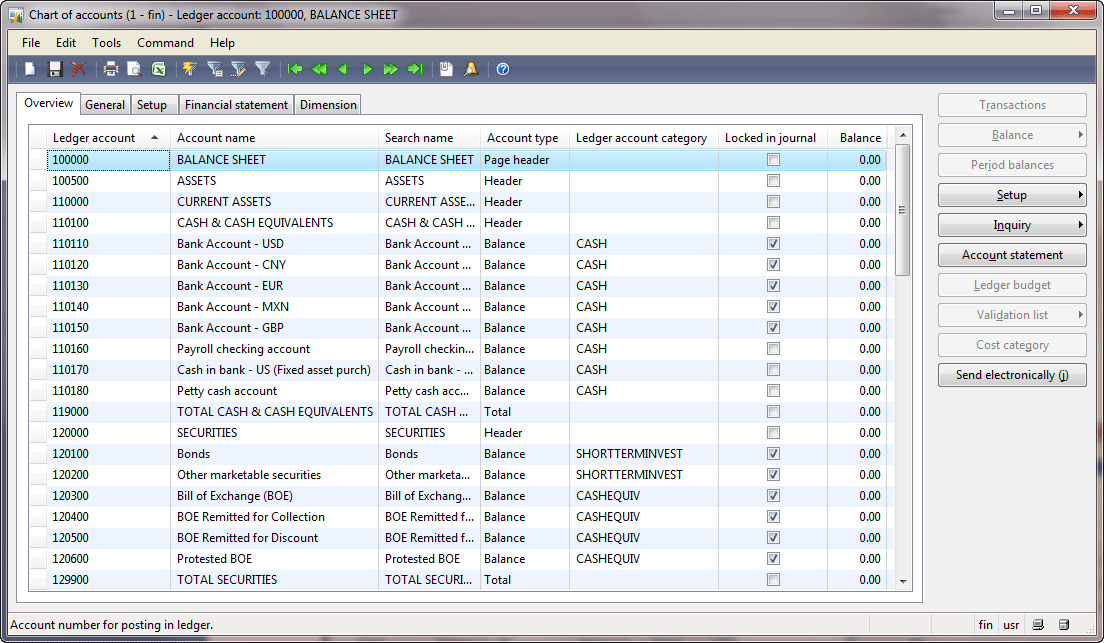

Account groups Account groupsA chart of accounts is a listing of the account names that a company has identified. In Microsoft Dynamics AX, the chart of accounts can be opened under General ledger > Common Forms > Chart of Account Details.  Chart of accounts Chart of accountsI use the demo data which contains a good example of the chart of accounts. There are the following accounts:

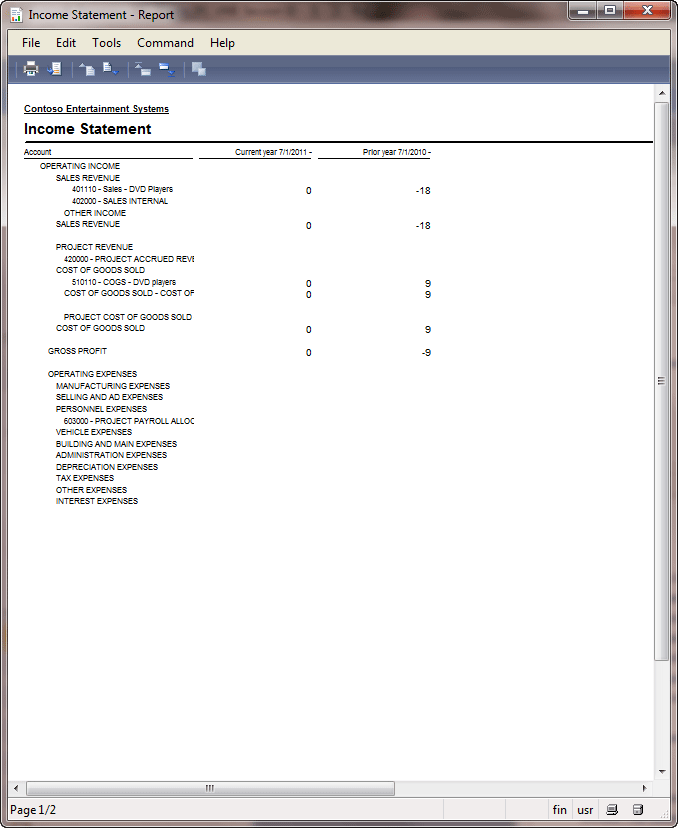

We will use some of these accounts when analyzing the purchase and sales transactions in Microsoft Dynamics AX. Financial Statements – Balance Sheet, Income Statement, and Cash Flow Statement When we purchase or sell, we use the circle to analyze the current financial situation in the company. The circle answers the questions how many assets or liabilities there are in the company for the current moment. In other word, the circle is a snapshot of the company’s financials. In accounting, instead of the circle the Balance sheet is used. The accounting balance sheet is one of the major financial statements used by accountants and business owners. The balance sheet presents a company’s financial position at the end of a specified date. Because the balance sheet informs the reader of a company’s financial position as of one moment in time, it allows someone—like a creditor—to see what a company owns as well as what it owes to other parties as of the date indicated in the heading. This is valuable information to the banker who wants to determine whether or not a company qualifies for additional credit or loans. Others who would be interested in the balance sheet include current investors, potential investors, company management, suppliers, some customers, competitors, government agencies, and labor unions. Example of a Balance Sheet. We already know how to answer the questions whether our company is profitable or not. To know this, it is required to sum the amounts of all profit and loss accounts. In our example, we have the Sales, Cost of goods sold, and Delivery expense profit and loss accounts. Accountants use the Income statement to see whether a company is profitable. The income statement is sometimes referred to as the profit and loss statement (P&L). The income statement is important because it shows the profitability of a company during the time interval specified in its heading. The period of time that the statement covers is chosen by the business and will vary (for the month, quarter, year). Keep in mind that the income statement shows revenues, expenses, gains, and losses; it does not show cash receipts (money you receive) nor cash disbursements (money you pay out). People pay attention to the profitability of a company for many reasons. For example, if a company was not able to operate profitably—the bottom line of the income statement indicates a net loss—a banker/lender/creditor may be hesitant to extend additional credit to the company. On the other hand, a company that has operated profitably—the bottom line of the income statement indicates a net income—demonstrated its ability to use borrowed and invested funds in a successful manner. A company’s ability to operate profitably is important to current lenders and investors, potential lenders and investors, company management, competitors, government agencies, labor unions, and others. Profit and loss contains the following elements: Revenues and Gains, and Expenses and Losses. Example of Income statement. Note that we prompt about the revenue when a product has been sold, regardless of when the money is actually received. But the Customer could not pay for our pizza for some reason. Similarly, the expenses reported on the income statement might not have been paid. You could review the balance sheet changes to determine the facts, but the Cash flow statement has already integrated all that information. As a result, savvy business people and investors utilize this important financial statement. We don’t analyze this statement. The Balance sheet, Income statement, and Cash flow statement are the major financial statements used by accountants and business owners. To know more about a Financial statement, I recommend you these articles: Balance sheet, Income statement, Cash flow statement. In Microsoft Dynamics AX, all statements are set up manually. The user defines the rows, columns, ranges etc. Our demo data already contains the setup for Balance sheet, Income statement, and Cash flow statement. To view the statement, do the following:

The total Asset amount is $19 (note that the report contains 2 pages, to view the next page click the Page Down button). Check the accounting equation: Assets = Liabilities + Shareholder’s equity. Note that for a sole proprietorship company, the difference between the Assets and Liabilities is called Owner’s Equity, for a corporation – Shareholder’s equity. On the second page, the total amount for Liabilities and Shareholder’s equity is -$19. According to the accounting equation, the Liabilities and Shareholder’s equity should be $19. In Microsoft Dynamics AX, the Balance sheet shows the total amount that is calculated as Debit – Credit for the Asset and Liabilities accounts! The accounting equation for the Balance sheet in Microsoft Dynamics AX looks as follows: Asset + Liabilities + Shareholder’s equity = 0. Note that in Microsoft Dynamics AX, the amount that is placed in the Credit part is shown as negative amount, the amount in the Debit part is shown as positive amount for all accounts (Assets and Liabilities). To view the Income statement, open the Financial statement form again, select IS (Income statement) in the Financial statement field, and click OK. The report looks as follows:  Income statement Income statementIn this example the OPERATING INCOME and SALES REVENUE are the header accounts. The “401110” and “402000” are the accounts. The OTHER INCOME is the header account. The Sales revenue is the Total account, etc. We can see that the Sales revenue is 18 in the Credit part and Cost of goods sold is 9 in the Debit part. The company’s profit is the sum of all P&L account totals. In this case, the Sales revenue total is Credit – Debit = 18 – 0 = 19. The Cost of goods sold total is Credit – Debit = 0 – 9 = -9. The company’s profit is 18 + (-9) = 9. We have already discussed that the company’s incoming are the liabilities because they should be returned to the company’s owners. The summarized P&L earning account contains 9 in the Credit part. In Microsoft Dynamics AX, the Credit part always shows negative values. If we look at the second page of the Income statement, we can find that the incoming equal -9. Accounting Cycle We already know that some company operations (purchase, sales) should be recorded as transactions (that move amounts from one accounts to others). In this paragraph, we will learn all the steps from the business operation till the financial statement. This flow is called the accounting cycle. This is what an accountant does. The accounting cycle is the sequence of procedures used to keep track of what has happened in the business and to report the financial effect of those things. The following is a depiction of the steps in the accounting cycle and a brief description of each.

Let’s recall what have been studied in this training lesson:

Technorati Tags: Accounting, Accounting Cycle, Accounting equation, Accrual basis of accounting, Assets, Balance Sheet, Chart of Accounts, Credit, Debit, Financial in Dynamics AX, Income Statement, Liabilities, Owner’s Equity, Profit&Loss accounts Источник: http://www.dynamicsaxtraining.com/fi...basic-concepts

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|